Nous avons trouvé contenus pour ""

Désolé, nous n'avons pas trouvé de résultat. Veuillez poser une autre question.

Cette recherche n'a pas pu être traitée en raison d'un trop grand nombre de tentatives en peu de temps. Veuillez réessayer plus tard.

sur

The State-guaranteed loan (SGL): our customers and advisors are the best spokespersons!

Wednesday, 22 april 2020

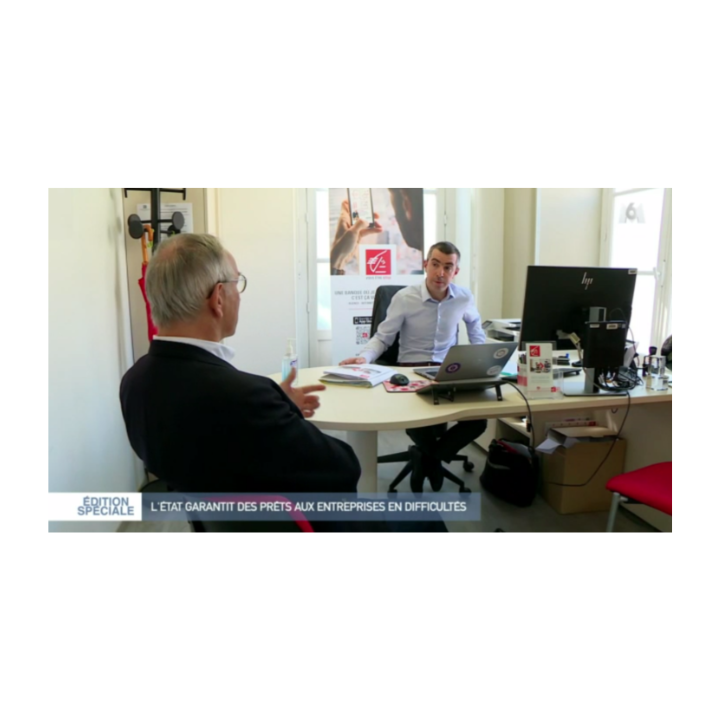

In a report in its special 7:45 pm news program aired on April 18, the M6 TV channel returned to the question of how the rollout of the State-guaranteed loan (SGL) was proceeding in France.

Two people in particular had been invited to the studio to share their experience: Philippe Gobinet, CEO of the Orléans-based Partnaire group of temporary employment agencies, and his bank advisor Cédric Tourne, account manager at the Caisse d’Epargne Loire Centre.

Like other business leaders in the Loiret region, Philippe Gobinet has received the support of the state-guaranteed loan for a total of nearly 3 million euros. “Without this loan, things would have been difficult for us because we have to pay the wages of our temporary employees as well as the salaries of our permanent staff. And we would have become caught up in cash flow problems,” he said.

To take out the loan, everything was wrapped up in barely four days. “The state-guaranteed loan allows you to borrow up to 25% of your turnover with a one-year deferment period. At the end of the first year, Mr. Gobinet can choose either to repay the loan in full or in part or, alternatively, opt for a repayment period of up to 5 years,” explained Cédric Tourne.

As at April 20, the Caisse d’Epargne Loire Centre had received 1,000 applications for State-guaranteed loans for a total of 131 million euros.

And at Group level, as at April 17, more than 82,500 applications for a total of 15.8 billion euros had been received.

Photo: In the foreground, Philippe Gobinet, CEO of the Orléans-based Partnaire group of temporary employment agencies and his banking advisor, Cédric Tourne, account manager at the Caisse d’Epargne Loire Centre.