The sports industry takes its bearings

[February, 2020] Following on from the economic studies on SMEs carried out by our economists, we are now publishing – in association with BPCE L'Observatoire/Sports economy – an original analysis of the economic, statistical and behavioral aspects of the sports economy. The aim of this research is to understand the impact of this industry in France, to identify its players and the economic challenges it faces, and to define the specific characteristics of this sector at a local and regional level.

The sports economy is riding on the wave of new societal expectations

In recent years, the practice of sporting activities has enjoyed steady growth in France.

According to the Sport & Health barometer survey carried out in 2017, 61% of French people say they engage in regular physical activity, i.e. a rise of seven percentage points vs. 2012. This increase can be explained, in part, by a change in the profile of those practicing sport (more women and senior citizens) and by the emergence of new habits. Indeed, in recent years, the individualization of sporting activities has gone hand-in-hand with the appearance of new motivations linked to health, relaxation, and conviviality. These developments explain the rise of sport “on-demand” (offered by private commercial service providers) but also the increase in independent practice (free of all supervision structures), which now represents the most frequent form of physical exercise.

However, it is through associations that sport has traditionally been organized. Today, these sports associations must adapt to the gradual yet far-reaching metamorphosis in the profile of people practicing sport. As they depend on access to public facilities that have to be shared, associations are finding it more difficult to gain in flexibility, unlike their private competitors, who are making strong progress notably in large urban areas and tourist destinations. Their ability to respond to these developments is, however, crucial to the extent that associations play a key role in teaching sport and in the preservation of the values associated with it.

To watch this YouTube video, you must accept cookies from the Social Networks category, which includes YouTube, by clicking here.

In 2017, 61% of French people said they engaged in regular physical activity, 7 percentage points up on 2012.

The sports economy: an industry in its own right

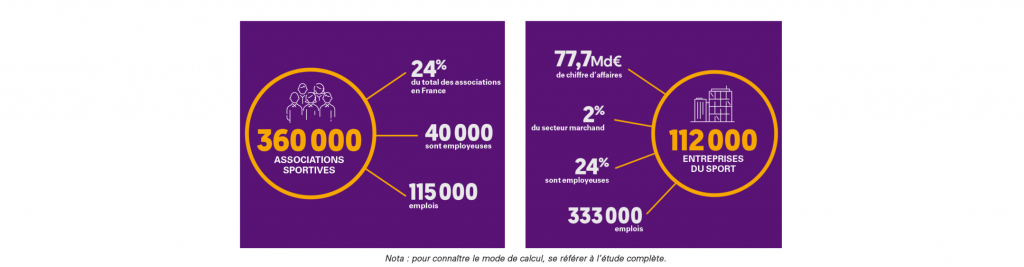

The sports sector, which brings together two types of players – associations, of which there exist around 360,000, and companies numbering 112,000 – is a highly integrated economic branch, serving demand for sports activities.

The sector’s main areas of activity are as follows:

• The first two groups bring together the players responsible for ensuring access to sport: the structures giving a framework to sporting activities (gymnasiums, associations, coaching, etc.) and players in charge of sport’s ‘spectacle’ dimension (major international sports events, professional sport, etc.).

• Upstream of the actual practice of sport, there exist two different realms. The first is essentially the commercial sector: the manufacture and distribution of sporting goods. The second realm brings together the supporters of a supervised practice requiring specific infrastructures: this includes the production of both public and private sports facilities and their management.

• Downstream, there exists a market geared to satisfying needs: the needs of other players in a B2B relationship (advice, communications) and needs of consumers in a B2C relationship (specialized media).

For sports companies, significant disparities in terms of performance

Against a background of strong growth in market size and a rapid restructuring of the supply of services, the sector does not yet seem to have reached full maturity. Indeed, although sports companies have become an economic sector in their own right – accounting for 2% of turnover generated by commercial activities and 2.2% of the salaried workforce in France – there still exist major disparities in terms of individual performance on the one hand, and between individual sectors on the other.

Partly linked to the massive entry of new players who, in order to reach a critical threshold and defend their market share, are taking on more risk, there has been observed a widening of disparities in economic performance (represented by the margin rate) and solvency (represented by shareholders’ equity related to the balance sheet) over the last five years, varying sharply between companies enjoying revenue growth, and the others.

Varying dynamics according to the business sectors of the different sports companies

The market – in the throes of fundamental change and characterized by significant differences in performance – is currently torn between, on the one hand, concentration around very large players, as is the case for gymnasiums, the distribution or manufacture of sports items and, on the other hand, fragmentation with the large-scale entry of very small companies and one-person businesses, as is the case for sports education or the rental of sports equipment. This dichotomy can be explained through a more detailed sectoral analysis.

Long-established sectors, such as trade and industry, are relatively stable and undergoing slow changes, although new factors (increasing international competition or the development of e-commerce) are likely to upset their equilibrium. On the other hand, activities giving a framework to the practice of sport are currently undergoing major changes related to the significant increase in demand with the arrival a large number of new entrants every year.

Sport, a lever for revitalizing the local and regional economy

For demographic, geographical, economic or socio-cultural reasons, the presence of sports companies is unevenly spread across France, both in terms of the number of companies as well as their economic impact and the diversity of sectors represented. The relatively classic rationale of geographical presence corresponds to the traditional location of companies in France with a strong concentration around large urban areas. The head offices of the major sports companies are chiefly located in the Paris region, but also in the North with the Decathlon brand: between them, the three départements of Paris, Hauts-de-Seine and the Nord account for more than 20% of sports companies’ aggregate workforce. This “head office” effect further increases the regional concentration of the sales generated by these large companies despite the fact that the wealth they produce is derived from the activities of their entities scattered throughout the country.

20% of the workforce of sports companies is concentrated in three départements.

Innovation and the sports economy: a winning duo

Ultimately, we note above all that activities pursued by specialized services and those dependent on consumer proximity are the ones located in densely populated areas. Industrial activities such as manufacturing, equipment rentals or sports tourism reflect other rationales governing the choice of a geographical location, that are often historical and geographical in nature, related to the physical advantages of the different regions. These activities are more concentrated around specialized hubs, sometimes operating in clusters, either with a view to consolidating existing sectors or to developing synergies with other industries. Indeed, in the field of sport, there exists a large number of clusters and incubators: nearly thirty in all, half of which are focused on innovation (Sport Tech, health) and the other half oriented towards more traditional sectors in which France boasts real expertise (horse riding, water sports, etc.). What is striking in this area is less the number of clusters but more their growth in recent years: since 2015, seventeen new clusters and incubators have been created, including four in 2019. This increase reflects an awareness of the potential of the sports economy.

Sports associations, vectors of social links

The non-profit model of associations makes it possible to maintain the offer of services in low-density regions: the distribution of the association offering is, in this respect, a strong indicator of the social role played by sport.

Associations rely on the high density of sports facilities in rural areas and, through their actions, contribute to the quality of life and social cohesion that local authorities want to preserve at a local level by investing in sporting activities. Regions displaying lower rates of demographic dynamism possess larger numbers of small associations operating solely on a voluntary basis. In urban areas, on the other hand, the population has moved more rapidly towards a more individual and independent vision of sporting activities based on a private service offering.

Strong territorial disparities in access to sporting activities

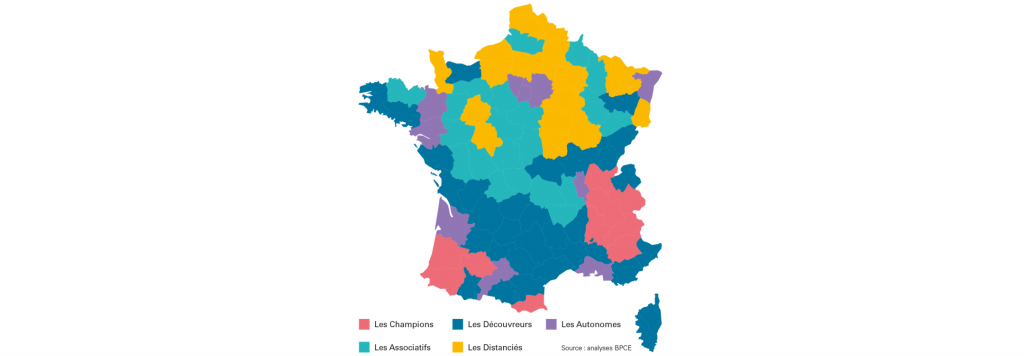

The départements in metropolitan France are characterized by five different profiles, depending on the service offering available.

• The Alpine départements, “Champions” in terms of access to sports activities, combine an abundant private and associative service offering thanks to major geographical advantages and good economic and demographic dynamics.

• In the départements of regional urban areas, the “Autonomous” areas are chiefly served by a private service offering providing the flexibility they require.

• Some territories, the “Associative” départements, rely on an offering provided by associations and the strong involvement of the public authorities to maintain local sports activities.

• The “Discoverer” départements benefit from geographical characteristics favorable to the development of sports tourism, served by a private service offering, while the maintenance of a network of associations accompanies the practice of sporting activities.

• Finally, in 19 départements – “the Laggards” – the practice of sporting activities is in marked decline: they suffer at the same time from a lower density of sports facilities and associations and are rather fragile economically, attracting little offering from the private sector.

The 2024 Paris Games: an opportunity for the industry

The organization of the 2024 Olympic and Paralympic Games in Paris is seen extremely positively by the different players in the sports economy in France. Indeed, according to the Kantar-BPCE survey, 90% of these entities think that staging this event in France is a good thing.

As a result, 87% of the companies and 72% of the associations expect spin-offs from the organization of the 2024 Paris Games, more in the form of collective benefits for the sports ecosystem as a whole (increase in the practice of sport) than via the economic impact the Games may have on its individual players, even if the majority of them, especially among the business entities, cite at least one economic benefit such as the construction or modernization of sports facilities, or an increase in funding for sport.

Among the industry’s players expressing reservations, however, what they fear the most is the unequal impact of the benefits: the fear, for companies, that the benefits will chiefly be concentrated in the construction and hotel industries and, for associations, that the benefits will mainly accrue to large structures, with both categories worrying that the Ile-de-France region will eclipse all the others.

This research shows the importance of mobilizing all of France to share in the spirit of the Paris 2024 project, a decisive factor in generating a lasting legacy. Calls for tenders open to all companies regardless of their size, the dissemination of training centers throughout France, and the creation of the Terre de Jeux (“Land of the Games”) 2024 label are different ways to boost a global sporting dynamic if they are supported by appropriate policies at the local level.

Groupe BPCE is the first Premium Partner of the Paris 2024 Olympic and Paralympic Games: to learn more, click here

Consult here all studies published by BPCE’s experts on the sports economy