The sports industry on tenterhooks!

[February 2021] The health crisis has changed the game for the sports industry but how exactly? And what will the consequences of this transformation be? BPCE L’Observatoire provides fresh insight into the question.

A sharp decline in business activities

According to statistics compiled by BPCE L’Observatoire, the business activities of the sports industry suffered an estimated 21% collapse in 2020 versus 2019, i.e. a much deeper decline than the estimated contraction for the French economy as a whole (-8% according to INSEE, the National Institute of Statistics and Economic Studies). If growth previously expected in 2020 is taken into account, it is estimated that the decline in business activities triggered by the health crisis stands at 25%; one out of every four sports companies reports a collapse in business of more than 50%. It is consequently not rare for companies to find themselves in dire situations.

77% of sports companies saw their sales figures collapse in 2020

Factors explaining why many businesses remain resilient

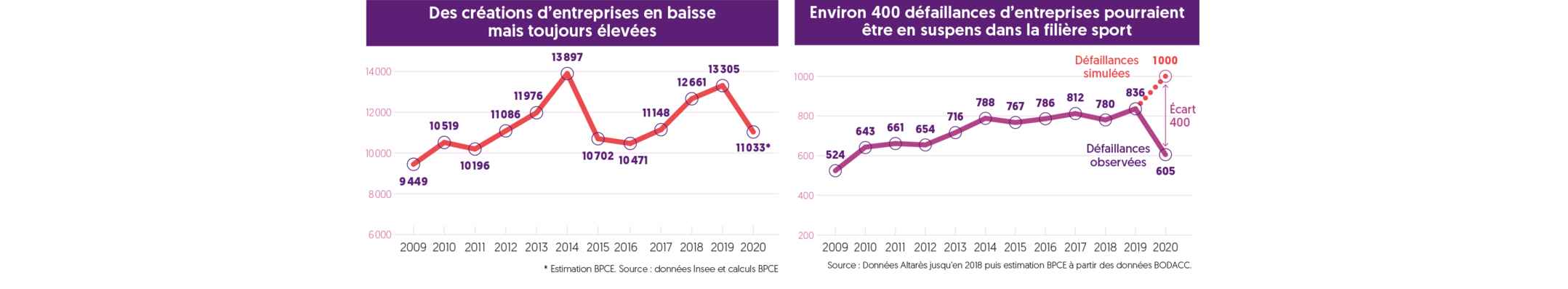

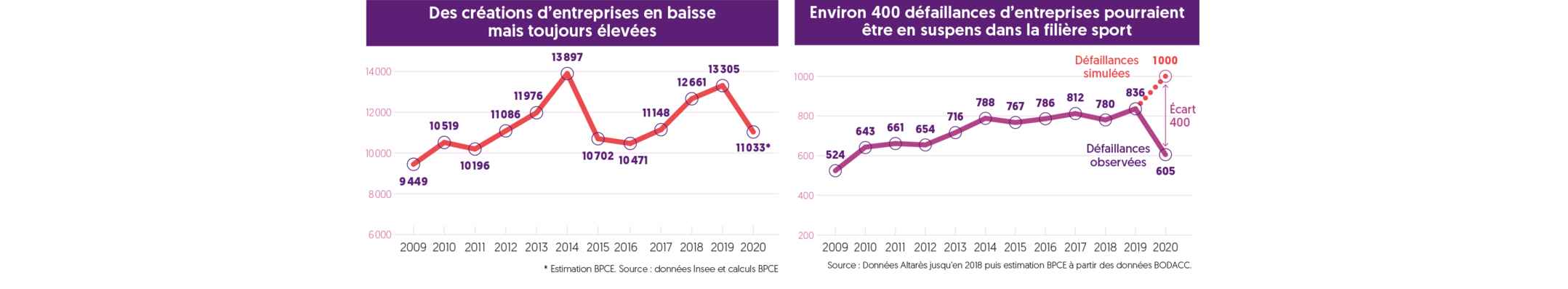

Paradoxically, the number of new creations remained high during this period (sports coaches and teachers account for about two-thirds of new businesses set up in the sector in recent years but these entities are almost entirely companies with no employees) while the number of bankruptcies has declined by 28% to its lowest level in 10 years (explained by the raft of government measures proposed in particular to protect companies’ cash flow positions).

The ability to withstand the crisis varies according to company size – with VSEs and SMEs more seriously impacted than others – but also according to the growth strategy adopted by the entity. Some businesses have preferred to increase their indebtedness rather than consolidate their share capital; this is the case for some intermediate-sized enterprises, notably professional clubs (especially soccer clubs) that depend on revenues from TV rights and ticket sales.

Associations faced with major problems

The Covid-19 crisis has not spared sports associations whose average decline in revenues is estimated at approximately 30% in 2020 versus 2019.

70 % of them declare smaller budgets in 2020 and, for 20% of them, down by more than 50%. The acute sensitivity of sports associations to the crisis can be explained in part by the atypical structure of their sources of income based less on public subsidies than on income from the use of their services (membership fees, organization of events, etc.). This leaves them exposed to the vagaries of the economic climate and, consequently, more vulnerable to the current crisis. Finally, just like the size of companies determines their ability to withstand the crisis: the smaller the association, the greater their difficulties.

30%

This is the estimated decline in the income generated by sports associations in 2020

Cash flow, the major preoccupation

The two main difficulties encountered by companies during the health crisis are the collapse in demand and cash flow problems. Concerns about debt and equity remain of secondary importance, testifying to the fact that companies are still preoccupied simply by the need to survive!

Smaller entities specializing in teaching or running gyms and sports clubs are more sensitive to cash flow issues while larger structures specializing in manufacturing and wholesale activities are more concerned about how and when the economic recovery will begin. When asked about their company’s solvency, 70% of managers express reservations about the strength of their balance sheet while 23% consider their balance sheet to be fragile.

Government assistance deemed vital

Virtually all companies and associations with employees say they have taken advantage of one of the government assistance programs, the nature of the support depending on the size of the company and, to a lesser degree, on the state of its balance sheet. The demand for state-guaranteed loans increases in line with the size of the company’s sales and the strength of its balance sheet but, at the same time, the more a company grows, the more it builds up its own cash reserves. As a result, 57% of the overall loan envelope was still available at the end of 2020 according to the BVA-BPCE survey.

38% of companies have taken advantage of the state-guaranteed loan.

The pace of digitalization has accelerated but the diversification of the offer remains limited

The Covid-19 crisis has accelerated the process whereby entities active in the sports industry have developed a digital presence insofar as these tools proved necessary to ensure, for most of them, their ability to continue their activities. More than one half of the sports companies had digitized their services by the end of 2020 and many sports associations, not particularly committed to digital solutions before the crisis, have developed remote coaching services or online course platforms since the onset of the epidemic. As a result, the implementation and increased use of digital tools have been one of the prerequisites for the ability of the majority of sports sector entities to survive the crisis.

At the end of 2020, only 40% of companies had launched a process enabling them to diversify their offer and where they have, the decision was more in order to accompany changes in demand than to respond to the crisis itself. The pace of their diversification is expected to accelerate as the crisis draws to an end.

A different attitude towards sport

When asked about future changes in how people practice sport, entities active in the sports sector anticipate an acceleration of what are already observable trends (notably the fact that physical activity is now practiced more to improve the quality of one’s life or health than for the sake of enhanced personal performance). Sports associations, in particular, expect an increase in à la carte sports practices and the organization of individual classes in line with practitioners’ demand for flexibility and autonomy. Although not all companies have adapted to these changes, they are nevertheless aware that they need seriously to reappraise their offer. For everyone involved in sport, these new trends will inevitably involve an increased use of digital tools whether for the organization of sporting events, with the help of digital applications, or for the very practice of sport with online coaching and the increased use of connected objects.

Continued massive popular support for Paris 2024

82% of sports associations and 89% of companies consider the organization of the Paris 2024 Olympic & Paralympic Games to be a good thing or even, for half of them, a “very good thing.” The event is also overwhelmingly perceived as a turning point or the start of a new cycle in the sports industry. 70% of the companies included in the survey are confident in “the ability of the Olympic & Paralympic Games to give a fresh boost to the sports industry” after the crisis, and 42% of the associations questioned think that the Games represent “an opportunity to mitigate the impact of the health crisis.”

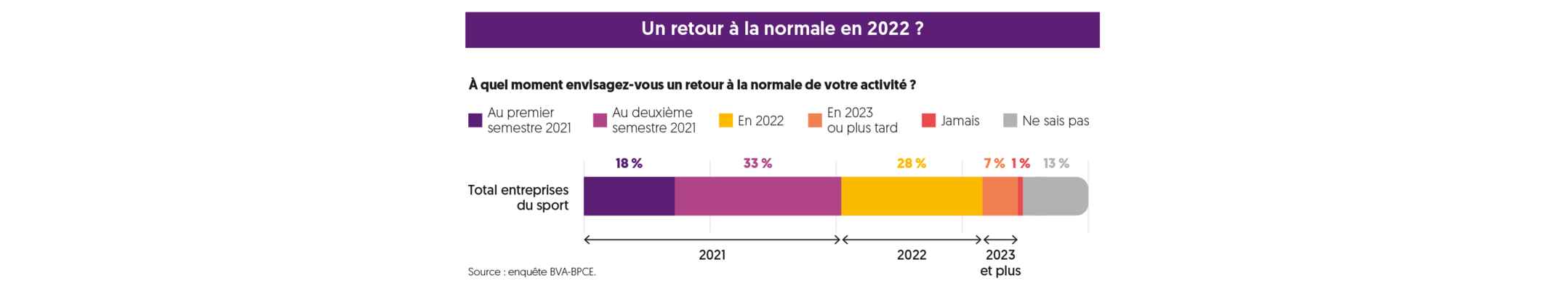

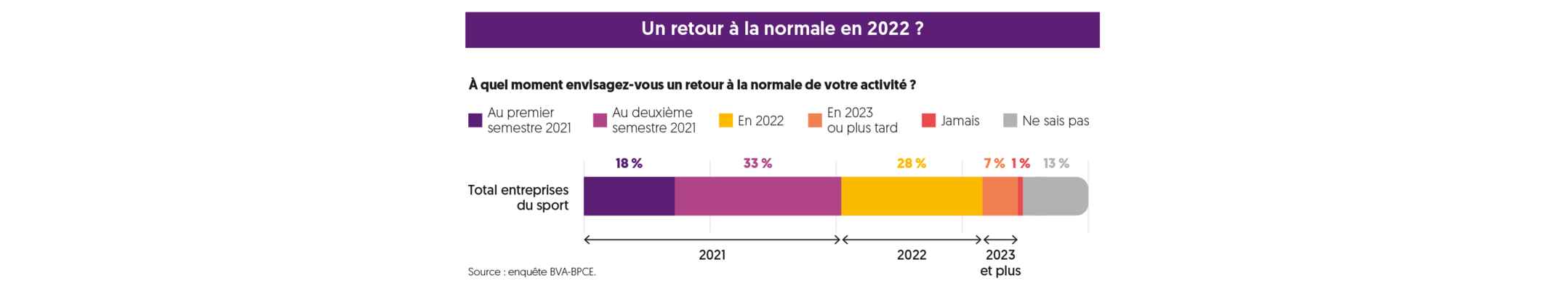

Back to normal in 2022?

74% of sports entrepreneurs feel confident about the future of their own businesses and 66% believe that the sector as a whole will be able to enjoy new growth in the medium term. However, the degree of business confidence in the future increases with the size of the company and depends on how severely the company has suffered from the shock of economic recession. Despite these disparities, nearly 80% of sports companies expect business to return to normal by the end of 2022 at the latest. As far as associations are concerned, more of these entities anticipate a decline in their main sources of funding (public subsidies, membership fees, revenues from sporting events, and private sponsorship) rather than an increase in the 2022/2023 season.

Towards a change in business models…

For stakeholders in the sports sector, however, this more or less rapid and arduous return to ‘business as normal’ will involve structural changes in their activities more often than not: 44% think that their business model will have to be significantly adapted to current changes and 15% even consider that they will have to completely reinvent their activities, notably sports clubs and gyms. Because of the health crisis, sport has entered a (probably) long-lasting period of turbulence but the players are lucid about this and have already begun their transformation process.

44% of entities in the sports sector think that their business model will have to adapt to ongoing changes