We have found contents for ""

Sorry, we didn't find any results. Please ask another question.

Cette recherche n'a pas pu être traitée en raison d'un trop grand nombre de tentatives en peu de temps. Veuillez réessayer plus tard.

sur

The market downturn and uncertain outlook in 2024 encourage French households to adopt a wait-and-see attitude

[December 2023] BPCE economists give their analysis of the economic situation and their forecasts for 2024. Despite shifting market conditions, French households are still pursuing real-estate projects but they are revising their expectations.

12-month forecasts still expect prices to rise while demand remains resilient

12-month forecasts still expect prices to rise while demand remains resilient

Although French people’s intentions to buy a property over the next 12 months have remained stable over the past two years, current transactions are being put on hold in favor of plans for the coming months. Potential buyers view the economic situation more favorably than the average French person. This means that demand is buoyant and prices are still expected to rise: 39% of buyers expect prices to rise over the next year, compared with 31% who expect prices to fall. The perception of real-estate price trends is clearly becoming less bullish but the French are slow to accept a possible drop in prices.

39 % of French people think that property prices will rise over the next 12 months, compared with 26% who expect prices to fall.

Intentions to sell have declined slightly but still remain above their medium-term trend. Sellers also see the real-estate market in a less unfavorable light than the average French person, and the majority do not expect prices to fall. The large number of properties on the market, however, is inevitably strengthening the negotiating hand of increasingly selective buyers.

On the whole, the French are weighing up the slump in the market and reaching the conclusion that the present time is a less than propitious moment to buy or to sell, but they do not expect prices to fall.

The EPD is gradually establishing itself as a decisive factor in property valuations

The rollout of restrictive measures flowing from the EPD (Energy Performance Diagnosis) is having a more marked impact on the residential market, strengthening the bargaining power of prospective buyers. A dwelling classified as F or G (poor energy performance) on the EPD scale is the reason behind 43% of owners’ decision to sell, driven by their anticipation of a decline in the future value of their properties and their reluctance, for the most part, to assume the difficulties and expenses associated with energy renovation work. The EPD is becoming simultaneously an additional tool in property valuations, an argument in negotiations, and a motive for putting more mediocre properties up for sale, potentially increasing the supply side of the market equation. The two previously observed attitudes taken by buyers are being reinforced, on the one hand, by buyers who prefer to avoid acquiring F- or G-rated properties and, on the other hand, a minority who view these properties as opportunities.

43 % An EPD classification of F or G is a selling point for 43% of people wanting to dispose of their properties

The “green value” – i.e. the price difference between homes with a poor EPD classification (F or G) and those with an average quality rating (EPD classification of D, according to the notaries handling property transactions) – grew significantly between 2021 and 2022 both for single-family homes (where the impact of the EPD was already strong) as well as for apartments, where the impact had previously been less significant. In the context of a more sluggish market for existing properties, the proportion of F- and G-rated housing units in the total number of property transactions is growing and having a greater impact on overall price trends.

More generally, the market slowdown is fueling sellers’ concerns about how long it will take them to sell their properties (a concern shared by 59%) and whether they will have to consider reducing their prices (for 58%).

Mortgages, creditworthiness, and prices: new benchmarks are becoming established

Credit market activity strongly impacted by higher interest rates, and a delayed but massive decline in transactions for existing properties

Around 75% of people planning to buy a property say they have had to abandon, postpone or change their plans because of the rise in interest rates. This led to an almost 40% decline in new mortgages over the first 10 months of the year, and the change in loan outstandings (1.7% per annum) is now lower than the rate of inflation. The highlight of 2023 is the easing of the home-loan debt burden carried by French households.

In parallel with the shrinking credit market, but also related to the growing wait-and-see attitude adopted by households, the real-estate market has experienced a significant decline in activities for more than a year (with an estimated total of 870,000 transactions for existing properties in 2023), a downward trend that is gaining momentum and spreading to all French regions. The shifts in buyers’ preferences for geographical location have not disappeared, however, with a continuing trend in favor of regions on the outskirts of urban centers as well as medium-sized towns and even more rural areas.

Overall, the monthly pace of home sales does not reflect a collapse in the market but more a return to a standard long-term level. As a result, the turnover rate of the housing stock is falling but not to historic lows.

The rapid decline in home sales has gone hand-in-hand with a moderate drop in nominal prices

The drastic fall in transactions has been followed by a delayed and moderate adjustment in prices, although the trend could be observed a little earlier in certain major conurbations (Paris, Lyons, etc.). A prominent feature of the different real-estate markets in France is their heterogeneity, as confirmed by the fact that property prices continued to rise in certain cities – for example, the price of single-family homes – despite the wider prevalence of declining prices observed in the 3rd quarter to the point that the average housing unit price in France is down 1.9% year-on-year.

Against a backdrop of rapidly rising interest rates, a number of adjustment mechanisms are nevertheless supporting demand for real-estate projects: the continued lengthening of loan terms and the acceptance of a higher debt-to-income ratio combined with an increase in the down-payment ratio enable certain households to partially escape the negative impact of rising interest rates on their creditworthiness. Overall, from 2021 to 2024, these adjustment mechanisms, combined with the rise in nominal incomes driven by inflation, will offset almost half of the decline in borrowable capital available to households over the period.

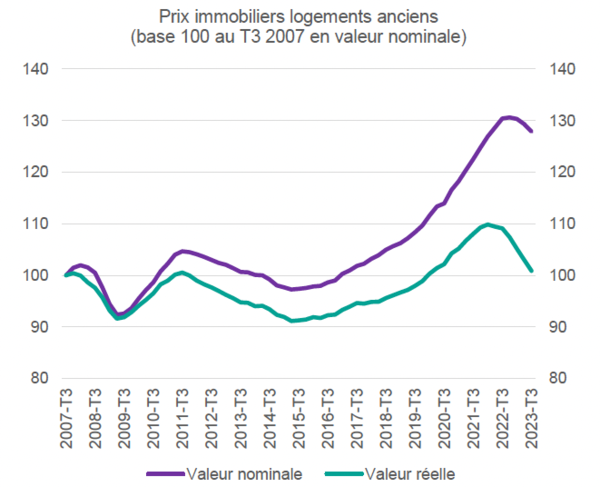

Generally speaking, in an inflationary environment such as that observed in recent years, real prices (after taking account of inflation) shed a more nuanced light on households’ loss of real-estate purchasing power. It’s true that average prices rose by 28% in nominal terms between Q3 2007 and Q3 2023 but, once inflation is factored in (i.e. once prices are expressed in real terms), prices have returned to their end-2007 level. The adjustment of prices therefore appears to be well advanced and, so far, seems to be driven more by inflation that by a nominal fall in prices, thereby limiting the loss of “borrowable capital” by households.

Graphique: In real terms, after taking account of inflation, prices returned to their pre-financial crisis level in Q3 2023 and, in 2024, are expected to fall to the low points reached during the financial crisis and Euro crisis.

Housing construction confronted by inflation and by a set of opposing forces

The crisis in the construction industry is visible both in the fall in the number of housing starts as well as the decline in the number of new building permits issued (a more advanced indicator), revealing a trend announcing a further decline in the sector, already at an all-time low.

The entire new-build sector (property development, construction of single-family homes) is being held back by a whole series of factors: higher construction costs rising at a pace faster than inflation, the regulatory environment that has historically weighed down on the construction industry’s business model (the most recent being the RE2020 environmental regulations), structural trends putting downward pressure on the market (scarcity and high cost of land, the “zero net artificialization” objective, the demographic decline of the workforce, etc.), and the impact of rising interest rates on the financial situation of construction and property development companies. This general rise in costs exacerbated by the loss of household solvency resulting from higher interest rates is creating a negative jaws effect frustrating an economic adjustment between supply and demand.

Continued downturn in volumes in 2024 and sharper decline in prices

The market for new housing has been hit faster and harder by the combined effects, on the one hand, of a situation that was already suffering before the Covid19 crisis and, on the other hand, a recessionary macroeconomic context. The sector had long been buoyed up by France’s housing policy that provided solid support during previous downturns. But, in line with the national challenges of the ecological transition, the public authorities are redirecting their efforts towards housing renovation, directing aid less towards new housing (termination of the so-called Pinel rental investment scheme in 2024, which had already become more restrictive in 2023, the refocusing of zero-rate mortgage loans, etc.) and more towards helping households to renovate their homes (increased budget commitments for the “MaPrimeRénov” subsidy program, the “Eco-PTZ” interest-free loans to finance energy-saving home improvements, etc.).

For the new-build sector, recovery from the crisis is likely to be slower and more difficult, as the crisis is not merely cyclical. It will require operators to find new, more efficient business models in line with environmental concerns, and to commit substantial resources to research and development. This far-reaching change could prove to be extremely challenging for some of the companies making up the productive fabric, and is liable to stretch over a long period of time. New housing starts are likely to remain below the 290,000 unit threshold in 2024, as was the case in 2023.

290,000 In 2024, fewer than 290,000 new housing starts (the same as in 2023).

Achieving the extremely ambitious housing renovation targets still seems difficult at the current pace of execution (approximately 70,000 major renovations completed in 2022, fewer than 90,000 estimated in 2023 for a target of 200,000 per year as of 2024). It is likely that the contribution of renovation to the activities of the building sector will not, in the near future, offset the shortfall in activity triggered by the decline in new construction work. In particular, the BPCE L’Observatoire survey shows that the proportion of French people planning to undertake energy renovation work within the next 5 years has remained unchanged over the past two years. French households are struggling to pass a milestone in terms of their awareness of the need to carry out this work and their motivation to do so.

In 2024, the credit environment looks barely more favorable than it did in 2023, with interest rates still high and unlikely to fall until the second half of the year, and the easing measures taken by the High Council for Financial Stability (HCSF) having little impact at a time in the history of the real-estate sector when the households targeted by these essentially technical measures (rental investors, etc.) are turning away from markets that they are finding less attractive.

– 6 % With more sluggish activity levels in transactions concerning existing housing, prices could fall by as much as 6% in 2024

Despite households’ strong motivations (desire to buy their own home, preparing for retirement, investing their assets, the prospect of passing on their property to the younger generations, etc.), the continuing slowdown in the sale of existing properties is expected to lead to 780,000 transactions in 2024. Prices should continue to fall and to spread to hitherto untouched geographical regions, with declines of -3% in 2023 translating into a contraction of -6% in 2024, bringing average prices back to their low points noted during the financial crisis. Beyond the overall context (interest rates, the EPD, imponderables of a geopolitical, economic and social nature), households’ expectations of lower interest rates and falling prices are likely to encourage and prolong an already noticeable wait-and-see attitude among both buyers and sellers.