The French are adjusting to long-lasting inflation

[June 2023] The 2nd edition of the BPCE Digital & Payments Barometer survey explains how the inflationary shock is impacting the purchasing patterns of the French, who are forced to adjust their spending behavior for certain types of purchases. It also focuses on the consumption of Generation Z and that of the rural population.

The Barometer survey reveals increasing changes in the consumption habits of the French in the face of persistent inflation. Young and rural consumers are at the forefront of these adjustments, a combination of having greater recourse to discount food retailers and the second-hand goods market, the adoption of smart digital behavior, and the continuing importance of the pleasure motive on spending decisions.

The pleasure motive remains strong while shopping in discount outlets explodes

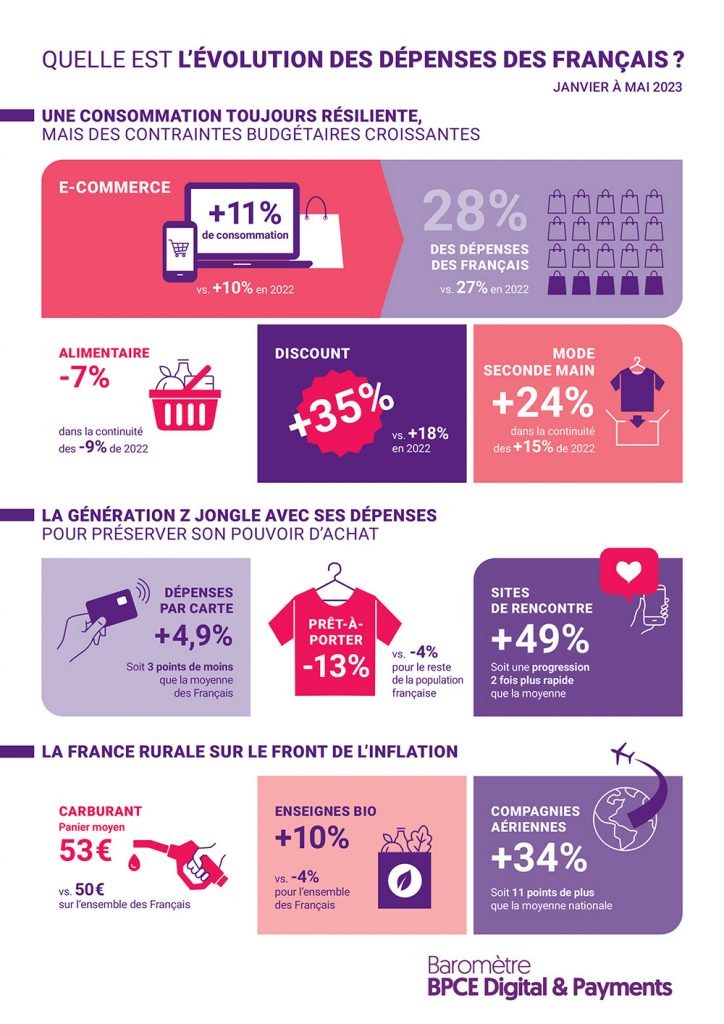

The first lesson to be drawn from the recent data published in the BPCE Digital & Payments Barometer survey is that overall consumption is holding up well, with 8% growth in card payments in the first five months of 2023. Although this growth rate is less impressive than the one achieved last year (+12%), it remains solid, nevertheless. After shoppers started to visit physical stores once again after the easing of lockdown restrictions – a development that benefitted brick & mortar retailers in particular – the e-commerce segment regained its ascendancy at the beginning of this year, enjoying 11% growth since January vs. 7% for physical retailers. Online consumption now accounts for 28% of all purchases made by the French.

Despite this growth, the signs of inflationary pressure are growing more intense. The price of fuel continues to rise for motorists (a further +2% over the first five months of the year, with motorists paying more than 50 euros to fill their tanks); consumers are continuing to cut back on their spending on food (-7% over the same period), even if the rate of decline tended to slow in the 2nd quarter; it is also worth noting the decline in business suffered by organic retailers, with a further -4% contraction since January.

At the same time, a set of new indicators reflect the increasingly constrained budgetary choices available to the French.

+35 % The discount sector doubles its rate of growth

The most impressive indicator is the explosion in sales enjoyed by the food and non-food discount sector. While 2022 already stood out as a boom year for this segment (+18%), it has doubled its rate of growth since the beginning of this year (+35%). This trend is driven by a number of underlying factors. First, new customer categories are turning to the discount sector. Between Q1-2022 and Q1-2023, the number of bank cards registering at least one monthly transaction in a discount store rose by 20%. This trend is particularly striking for urban consumers, previously under-represented vis-à-vis consumers in rural areas, and who now outnumber them proportionately as far as their purchases in discount stores are concerned. Second, an increase in the frequency of purchases in discount outlets has been observed, with the number of monthly transactions per customer rising by 9%.

+ 24 % increase in second-hand purchases in the ready-to-wear fashion segment

Another indicator – the ready-to-wear fashion sector, an iconic category of deferrable gratification purchases – has declined by 4% since the beginning of 2023 versus the 21% growth enjoyed in the same period last year following the easing of the lockdown restrictions. In what appears to be a form of behavior substitution, second-hand fashion purchases jumped by a total of 24%.

Finally, the categories of spending associated with a form of personal gratification – spending ‘ring-fenced’ by the French in their 2022 budgets – remained buoyant at the start of this year. At the very most, we note a slightly slower growth rate for the most expensive items (traveling, restaurants) in favor of spending on smaller, more accessible pleasures such as beauty care and cosmetics, or cinema outings. For example, spending on restaurants rose by a further 15% over the past five months, after enjoying 44% growth in 2022 driven, in particular, by people eating out in restaurants more frequently.

Generation Z: experts in resourcefulness

The age group most affected by inflation are young people aged 18 to 24 whose bank card spending has risen by only 4.9% since the start of the year, more than 3 points less than the French average. The strategies adopted by this generation to cope with the crisis deserve particular attention as they often announce trends more widely adopted by the general population in the future.

This age group’s shift to discount stores is even more massive, with purchases in discount outlets up by 41% since January. Similarly, their decision to stop buying new clothes is even more pronounced, with a 13% decline in ready-to-wear purchases over the first five months of the year.

36 % Proportion of digital spending (all age groups)

When it comes to digital spending (36% of young people’s consumption, the highest proportion of all age groups), young consumers are optimizing their spending but doing so selectively. They are abandoning home food deliveries (-6% since January) but, in contrast, the use of online dating sites is on the rise (+49%), with growth twice as fast as the average, even though the share of this type of spending in their budgets was already equivalent to the wider French average.

While young people continue to be over-represented in travel and social outings, we also note that they tend to use long-distance buses, trains and urban public transport more than the rest of the population.

Rural France: battling inflation

On the front line when it comes to inflation because of their higher mobility and energy expenses, consumers in rural areas are also forced to make more drastic trade-offs than the average French population.

Faced with the higher price of fuel (up 4% since the start of the year), they are increasingly tightening their belts when buying food: -14% over five months, a decrease twice as fast as the national average. On the other hand, they seem more attached to organic retailers than the urban population: in this respect, they are bucking the national trend with 10% more purchases in this segment since January.

+34 % increase in spending on air travel by consumers in rural areas

Contrary to the national average, rural consumers seem determined to give themselves a little respite: travel and eating out are continuing to grow at a steady pace with, for example, 34% growth in spending on air travel since the beginning of January, 11 points higher than the national average.

In conclusion

In light of these mid-year trends, a number of developments will need to be monitored to understand how French consumers are reacting to lasting inflation: will the tourist season confirm the decoupling between ring-fenced ‘gratification’ spending and limited budgets for the payment of utility bills? Will deferred purchases – notably, spending on ready-to-wear fashion – recover after a few months of sluggish performance? Will trends emerging in certain categories of the population that have been hit particularly hard by inflation, spread beyond these groups? The comprehensive update of the BPCE Digital & Payments Barometer survey at the end of 2023 should shed light on these different questions.

For further details (only in French)

Presentation of the BPCE Digital & Payments Barometer – June 2023

Document PDF – 2,8 MB

Infographic about changes in French consumers’ spendings – June 2023

Document PDF – 45,6 KB