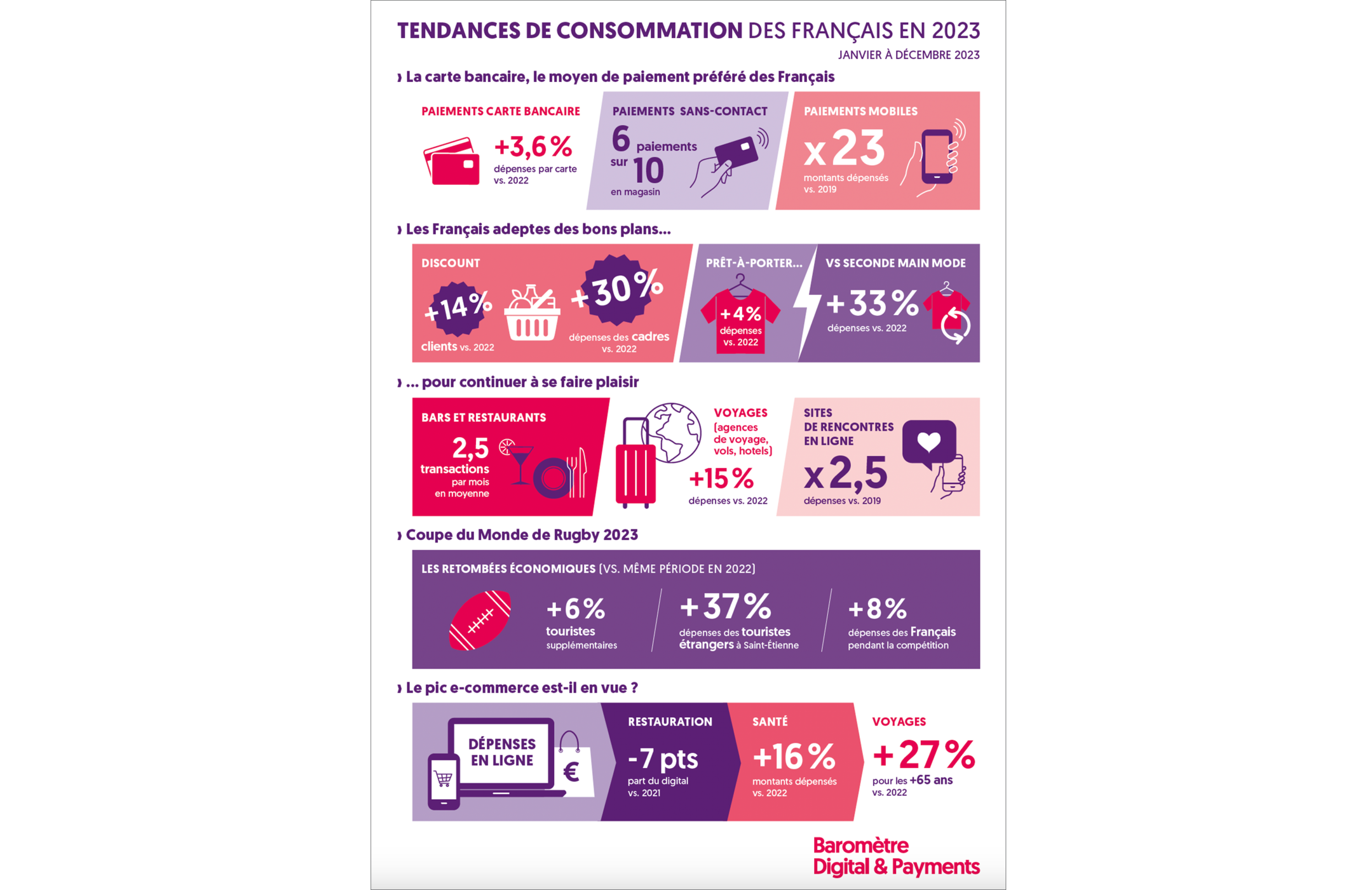

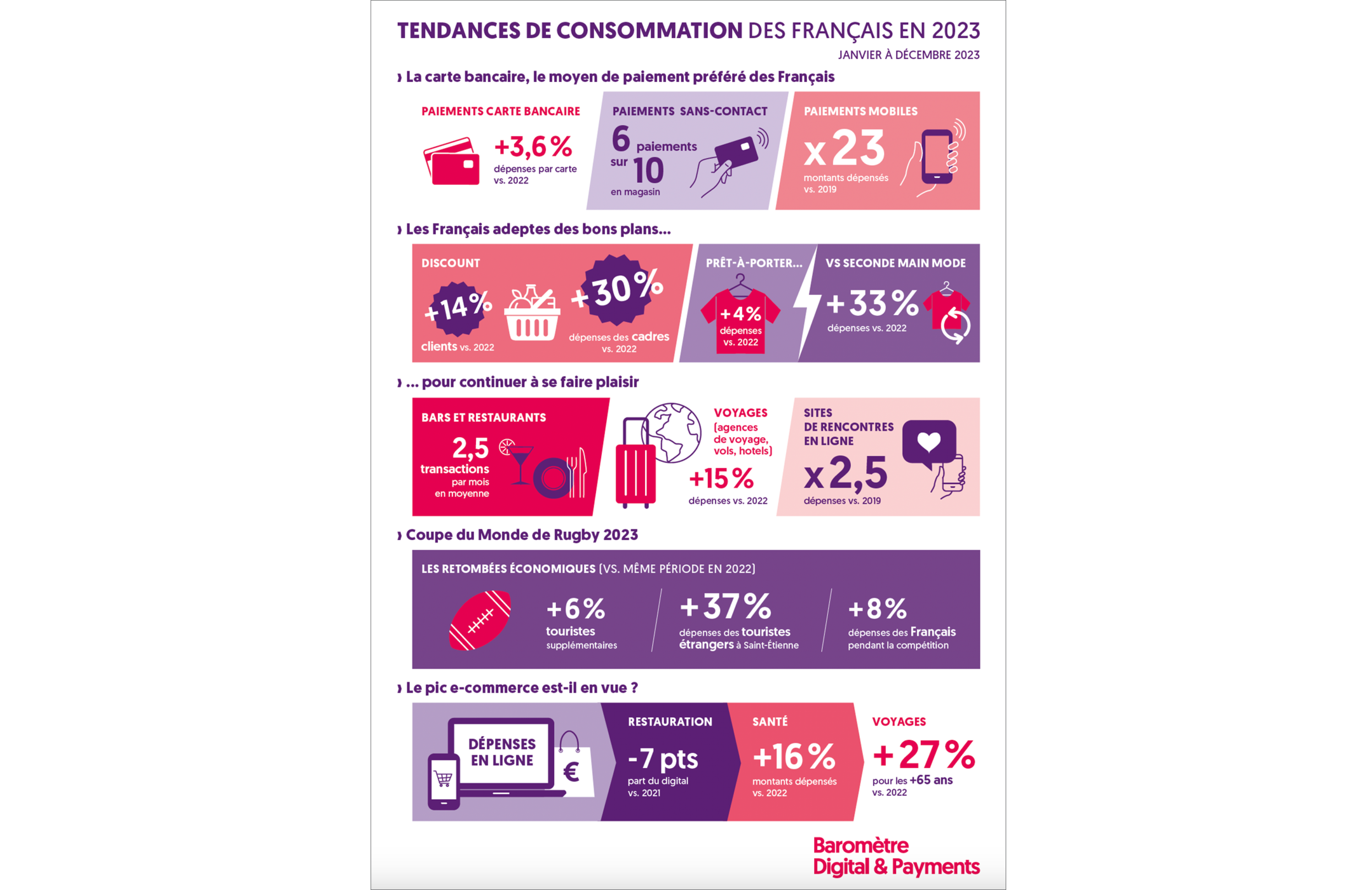

The new consumer trends adopted by the French in the face of persistent inflation

[January 2024] Every year, Groupe BPCE publishes a detailed analysis of purchases made with the 20 million bank cards held by the Group's customers (i.e. one out of every five cards in circulation in France). This study offers unique insight into consumption patterns in 2023 and explains how the French have adapted their buying behavior to the economic environment.

Consumers are developing multiple strategies to preserve their purchasing power, notably through shopping in discount stores and buying second-hand goods.

In response to a generally gloomy consumer environment, the French are adopting new strategies to recover their financial room for maneuver:

The discount sector stands out as the big winner of 2023. Spending is up by 21%, and the sector is attracting a wider audience, with a 14% increase in the number of consumers. New categories of customers are also rapidly adopting the concept: customer categories comprised of residents of major metropolitan areas, as well as executives and higher intellectual professions, are up by +30%.

The second-hand segment has been booming since 2019, and enjoyed further strong growth in 2023. Second-hand fashion enjoyed +33% growth in 2023, after expanding by +15% in 2022. It has even received a true vote of confidence from certain consumer segments that had previously remained on the sidelines. For example, consumers aged 55 and over have increased their spending by +50%.

Even under pressure, the French continue their search for pleasure

Despite the constraints, the French have not given up on pleasure-oriented consumption linked, in particular, to socializing, going out, traveling or virtual escapism (digital entertainment), or related to their self-image.

This trend in favor of socializing and well-being transcends socio-professional categories and age groups. Already emerging last year, it reflects a lasting shift in French consumer preferences.

E-commerce reaches a plateau in certain sectors

Until now driven by a self-driven dynamic, the performance enjoyed by e-commerce is now tending to converge with the rest of the economy. After peaking in the Covid years, its share of total French consumer spending has plateaued at 27%.

Nevertheless, pockets of growth remain in specific sectors such as mobility, healthcare or online garden centers and pet shops, and for certain consumer categories, such as people aged 65 or more who increased their overall online spending by +16% in 2023.

The impact of a major sporting event on consumption in France

The Digital & Payments 2024 Barometer survey reveals that the Rugby World Cup 2023 had a positive economic impact on many sectors of the French economy, beyond tourism. Although tourist spending remained stable, rugby fans consumed more in transportation, bars, food stores and bakeries, while other related sectors also benefited from a knock-on effect.